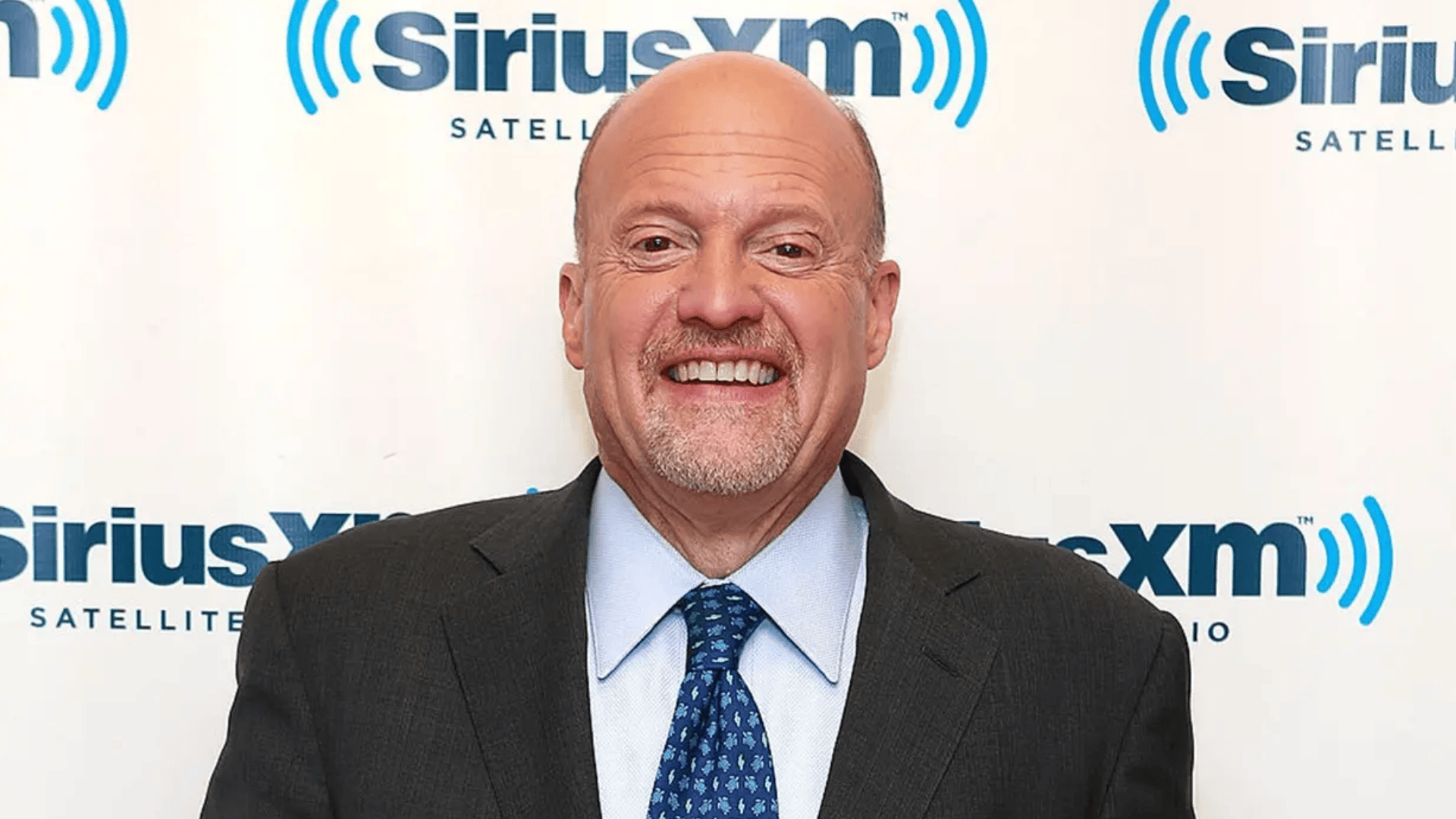

Jim Cramer went from shouting “BUY! BUY! BUY!” on TV to building a fortune worth millions by turning stock picking into entertainment and real business.

As the high-energy host of CNBC’s Mad Money, he became one of the most recognizable faces in financial media, known for bold calls, rapid opinions, and market theatrics.

Behind the showmanship is a serious financial background: before television, Cramer worked on Wall Street, ran a hedge fund, and built credibility with real investing experience.

Over time, he expanded into media, books, speaking, and brand partnerships, leveraging his name into multiple income streams, helping define Jim Cramer’s net worth today.

Jim Cramer Net Worth & Salary (2025)

Jim Cramer’s estimated net worth in 2025 is $150 million, making him one of the wealthiest personalities in the financial media.

This substantial wealth accumulation spans decades of success across multiple ventures, from his early career in hedge fund management on Wall Street to his current role as CNBC’s most recognizable television host and media mogul.

“Bears make money, bulls make money, pigs get slaughtered.”

This famous Cramer quote perfectly captures the investment philosophy that helped build his impressive fortune through disciplined trading and strategic wealth-building decisions.

Early Life and Education

Born in Pennsylvania and educated at Harvard, Jim Cramer’s early academic achievements laid the groundwork for his financial empire.

| Category | Details |

|---|---|

| Full Name | James Joseph Cramer |

| Birth | February 10, 1955, Wyndmoor, Pennsylvania |

| Family | Middle-class Jewish family; entrepreneur father, artist mother |

| Harvard University | Bachelor of Arts in Government (1977) – Magna Cum Laude |

| Harvard Law School | Juris Doctor (1984) |

| College Role | President of the Harvard Crimson newspaper |

Cramer’s elite Harvard education, combined with his teenage fascination with stock markets and early writing experience through newspaper leadership, created the perfect foundation for his future success.

Career Timeline and Media Success

Jim Cramer transformed financial television into an entertainment spectacle, creating a cultural phenomenon that influences millions of retail investors.

- 1970s–1980s: Began career as a financial journalist at American Lawyer and Los Angeles Herald Examiner.

- 1987: Founded Cramer Berkowitz hedge fund with $450,000 in initial capital, delivering ~24% annual returns.

- 1996: Co-founded TheStreet.com, a financial news website that later went public during the dot-com boom.

- 2001: Retired from hedge fund management, having accumulated more than $50 million in personal wealth.

- 2005: Launched Mad Money on CNBC, known for its theatrical style, sound effects, and the famous “Booyah!” catchphrase.

- 2008–Present: Navigated the 2008 financial crisis controversies, while evolving the Mad Money format into a mix of entertainment and financial education.

Cramer’s strategic career transitions from Wall Street to media created the foundation for his current $150 million net worth.

Current Income Sources (2025)

Jim Cramer’s diversified wealth strategy generates multiple revenue streams, ensuring financial stability beyond his television career through strategic investments and business ventures.

1. CNBC Mad Money Television Salary

Cramer earns approximately $5 million annually as host and executive producer of Mad Money.

His long-term contract includes performance bonuses tied to viewership ratings and advertising revenue, making him one of CNBC’s highest-paid personalities with guaranteed income security.

2. Book Royalties and Speaking Engagements

His bestselling investment books continue to generate substantial royalties, while corporate speaking events command $50,000 to $100,000 per appearance.

Combined, these intellectual property and personal brand monetization sources contribute an estimated $1 million to $ 2 million annually to his growing wealth portfolio.

3. Investment Portfolio Returns

Cramer maintains a diversified stock and bond portfolio that generates $3-5 million annually through dividends, capital gains, and strategic trading.

His decades of market expertise allow him to capitalize on investment opportunities while managing risk effectively.

4. Real Estate and Business Ventures

Multiple property holdings in New Jersey and New York, along with various business investments and partnerships, generate additional income streams worth $1-2 million annually.

These assets offer both passive income generation and long-term appreciation potential for sustained wealth growth.

Note: Income figures are estimates based on industry reports and public financial disclosures. Actual earnings may vary due to market performance, contract negotiations, and undisclosed business ventures.

Books and Publications

Jim Cramer has authored several bestselling investment books that generate steady royalties and reinforce his authority in finance:

-

Real Money: Sane Investing in an Insane World (2005)– Practical investment strategies, contributing to his annual royalty income.

-

Confessions of a Street Addict (2002) – Memoir of his Wall Street career, boosting his media credibility and speaking fees.

-

Jim Cramer’s Mad Money: Watch TV, Get Rich (2006)– Connects his TV recommendations with wealth strategies, strengthening his CNBC brand.

Key Takeaway: Cramer’s books monetize his expertise, provide passive income, and expand his media influence.

Personal Life

Beyond his high-energy television persona, Jim Cramer maintains a private family life while engaging in philanthropy and personal interests.

| Category | Details |

|---|---|

| Current Marriage | Lisa Cadette Detwiler (married 2015), real estate broker |

| Previous Marriage | Karen Backfisch-Olufsen (1988-2009), business manager |

| Children | Two daughters from the first marriage: Cece and Emma Cramer |

| Philanthropy | Supports educational charities focused on financial literacy |

Despite his manic television energy, Cramer maintains a stable family life and uses his wealth for educational philanthropy, particularly supporting initiatives that promote financial literacy.

Absolute Estate Ownership & Investments

Jim Cramer’s real estate portfolio represents a significant portion of his $150 million net worth, featuring strategic properties across high-value markets.

Primary residence in Summit, NJ (purchased for ~$4.7 million in 2008; current value higher due to appreciation); additional properties include a 65-acre rural NJ estate, and others in the area.

These properties serve dual purposes as personal residences and investment vehicles, benefiting from consistent appreciation in Northeast real estate markets.

Cramer’s real estate strategy focuses on stable, long-term appreciation rather than speculative investments, reflecting his disciplined approach to wealth preservation.

His property holdings generate both passive rental income and capital appreciation, providing portfolio diversification beyond his media and investment activities.

Controversies and Criticisms

Jim Cramer’s bold calls and theatrical Mad Money style have sparked primary debates about credibility and the role of financial media.

- Jon Stewart Showdown (2009) – Publicly challenged by Daily Show host over crisis coverage, leading to a televised apology.

- Bear Stearns Collapse (2008) – Infamously said “Bear Stearns is fine” at $62/share; it fell to $2 within days.

- Wharton Study – Analysis showed his picks underperformed the S&P 500 (4.08% vs. 7.07%, 2000–2017).

- Inverse Cramer ETFs –Inverse Cramer ETFs (e.g., SJIM and LJIM) were created to bet against his recommendations, but both were shut down (LJIM in 2023, SJIM in early 2024 due to poor performance and low assets).

- Regulatory Scrutiny – The SEC investigated the “Cramer Effect,” where his picks briefly moved stocks by 2–5%.

- Industry Skepticism – Many advisors label Mad Money more “entertainment” than serious investing.

Despite controversies and criticism, Cramer’s influence and popularity show that entertainment value often outweighs performance in financial television.

Wealth Management Philosophy: Spending He Refuses

Jim Cramer believes financial discipline means making intentional choices, avoiding unnecessary spending, and focusing resources on long-term sustainable wealth building.

- Expensive sports tickets (prefers cheaper seating options)

- Alcoholic drinks at restaurants (avoids paying steep markups)

- Luxury hotels and overpriced hospitality

- Name brands when generics provide the same quality

- Speculative or “harmful” investments (e.g., tobacco stocks)

By refusing wasteful expenses, Cramer demonstrates that lasting wealth depends not only on smart investments but also on disciplined choices in everyday spending.

Final Thoughts

Jim Cramer’s rise from hedge fund manager to media powerhouse reflects a career defined by bold moves, resilience, and financial discipline.

Through Mad Money, he remains both relevant and wealthy, blending education with entertainment and keeping millions of viewers engaged in investing.

While critics question his predictions, his influence on retail investors and financial media is undeniable.

Looking forward, Cramer will likely continue shaping conversations about money for years to come.

Want more insights into finance, investing, and wealth-building strategies? Stay tuned for the latest updates and expert breakdowns on Jim Cramer’s net worth.

Frequently Asked Questions

How Much Does He Earn From Mad Money?

He earns approximately $5 million annually hosting Mad Money on CNBC alongside other media income streams.

Is Jim Cramer A Billionaire?

No, Cramer is not a billionaire; his fortune remains in the hundreds of millions range.

How Does His Net Worth Compare To Other CNBC Hosts?

At around $150 million, Jim Cramer is significantly wealthier than most other CNBC television personalities.